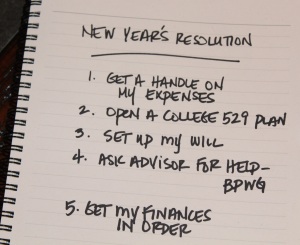

As a wealth advisor, I receive a lot of phone calls in January that deal with New Year’s resolutions about money. Of course, resolutions often come with negative associations. We’ve all been in the situation of getting really motivated at first, but seeing the enthusiasm fade quickly.

Like it or not, my clients know that once they open the door to change with me, I’m committed to helping them follow through on their initiative. Just ask anyone who tells me, they don’t have a Will! Do you need to set one up?

Today I want to share three of the most common financial resolutions that I come across and how you can get a jump start on them going into the New Year. I have to believe you’ll be happy with yourself for getting a head start!

1. I want to get my finances in order

If you feel like you don’t really have control over your financial life, this is a resolution that you might want to think about.

Financial planning can seem so hard before you get started, mostly because we’re often afraid of our spending habits. It’s easy to tell someone how much you earn — how much you spend, on the other hand, can be a really difficult issue to get your mind around.

Set aside an hour or two on one of these holiday weekends to tackle this issue.

Get started with my extremely easy-to-use Expense Analysis Worksheet to calculate where your money is going. You can even round up your spouse with some hot chocolate or eggnog to make it more festive. If spreadsheets aren’t for you, another option is to try one of the countless online tools.

Whatever tool you use, the first step is to have a clear picture of where your money is going. This will help you to re-prioritize your finances and reach your goals and dreams — it’s the key to a happy financial New Year.

2. I need to do something about retirement planning

Everyone knows they should be saving for retirement, but it can seem like an impossible goal to achieve. From the question of how much you should allocate to savings to how much income you’ll need, it’s very common to feel frustrated and intimidated. I’ve had a lot of clients who told me that they had avoided the issue for years before coming to me, just because it seemed impossible to figure out.

If you have a 401(k) available through work and you are not contributing, you should strongly consider it. Not sure how much you can save? Take the time to do the expense analysis worksheet discussed above, or, if that seems like too much too soon, use this trick: save your annual raise (of course, if you get one). It’s money you won’t miss, and you’ll feel great about getting started.

If you don’t have an employee-sponsored plan, don’t forget about the power of an IRA. You can’t contribute as much as you would with a 401(k), but these accounts can still be a great savings vehicle for your family.

Finally, if you have an old 401(k) account sitting somewhere from a previous employer, do yourself a favor and contact your advisor to review all options available to you through your old plan. It’s a very simple process, and it will be the start of managing your account again with more options and, quite possibly, lower fees.

3. I want to make sure I’m prepared to help my children with college

For my wife and I, the holidays are really all about the kids. Looking back through old photos to see how they’ve grown and coming back to the same family traditions each year are what make the holidays so special to us — because these activities remind us of all that we’re lucky to have.

Of course, the one thing we always want to do as parents is give more to our children. Holiday presents are great, however we all know what is really important: their future.

One of the best ways to help set your child up for the future is to open a 529 college savings account. These amazing savings vehicles give you the opportunity to help your child on their educational journey and provide great tax breaks so that your savings can grow more efficiently.

Planning ahead like this will bring you so much peace of mind, even if it’s challenging in the moment.

Happy New Year!

Whatever your New Year’s resolutions are, this is a great time to get started on those financial, professional, or personal goals that you’ve had in the back of your mind. It’s also an amazing time to reflect on how far you’ve come and on the good fortune you’ve enjoyed this past year.

Even in the hardest periods of our lives there is so much to be thankful for, and that, to me, is what the holiday spirit is all about.

With that, I want to wish you an incredible holiday season and a very happy New Year! Thank you so much for your readership, your trust, and your time.

.

Written by Bradford Pine with Anna B. Wroblewska

To learn about retirement savings, download my free eBook, “10 Tips You Need to Know About Your IRA Rollover.” This short book is packed with critical information that will help you make the right decisions about your retirement savings.

Written by Bradford Pine

Bradford Pine Wealth Group – New York City Financial Advisors

The views and opinions expressed in an article or column are the author’s own and not necessarily those of Cantella & Co., Inc. It was prepared for informational purposes only. It is not an official confirmation of terms. It is based on information generally available to the public from sources believed to be reliable but there is no guarantee that the facts cited in the foregoing material are accurate or complete.

Comments may not be representative of the experience of other investors. Investor comments and experiences are not indicative of future performance or results. Views and opinions expressed in the comments section are the author’s own and not those of Cantella & Co., Inc. No one posting a comment has been compensated for their opinions.

Comments are closed.