In the wake of the recession in 2008 and the recent economic turmoil in Europe, market volatility is probably a term you’ve become quite familiar with. After the relative calm of the early 2000s, the sometimes violent daily market movements we’ve seen recently have repeatedly stressed and worried even the most experienced investors. In this article, I will give you four tips to dealing with market volatility and taking advantage of its often-overlooked benefits.

In the wake of the recession in 2008 and the recent economic turmoil in Europe, market volatility is probably a term you’ve become quite familiar with. After the relative calm of the early 2000s, the sometimes violent daily market movements we’ve seen recently have repeatedly stressed and worried even the most experienced investors. In this article, I will give you four tips to dealing with market volatility and taking advantage of its often-overlooked benefits.

What is market volatility?

Put simply, volatility describes the upward and downward swings in the markets. A larger swing – say, if the S&P 500 rises 1 percent in one day – is an example of increased volatility, while a small swing of 0.01 percent would be considered a day of low volatility. Finance professionals track volatility using the Chicago Board Options Exchange Market Volatility Index, more commonly known (and more easily remembered) as the VIX Index. When the VIX is up, expectations for volatility are up, and when the VIX is down, expected volatility is, too.

The VIX can move quite rapidly from day to day based on changing expectations. Recently, in the wake of developing plans in Europe to address the crisis, the VIX fell almost 17 percent in the course of one day! In the past 3 months, the VIX has reached a reading of 48, and has generally hovered around the 30s before falling dramatically on the European news[i]. You may have noticed these pressures in the wild ride of your portfolio.

But knowing this information is only half the battle: How do you deal with it?

1. Remember that this isn’t unusual

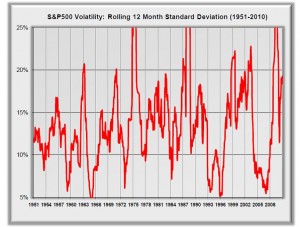

The past few years have been quite a roller-coaster, but the levels of volatility we’ve seen are not without precedent. As you can see from this chart, the 12 month rolling volatility from 1951 to 2010 has averaged about 15 percent, but high spikes and drops are not all that uncommon[ii]:

Thus, while the past few months have put a lot of investors under strain, it’s important to put things into long-term historical perspective and remember that this isn’t so unusual that we should panic. Indeed, volatility, or risk, is part of what makes equities such a good investment – which brings me to my next point:

2. Start looking at the long term

If you’re investing in a retirement account, such as a 401(k) or a Rollover IRA, you are likely working with a long time horizon when it comes to your equity allocation. Over the long run, volatility is what makes stocks such a powerful investment tool, as the potential gains can be higher due to equities’ higher risk. As such, getting drawn into the short term movements of your account, say, on a day-to-day or month-to-month basis, is a mistake. It’s not only unhealthy for your peace of mind, it may lead you to make emotional decisions in the short run, such as selling into a falling market, which could hinder the performance of your account in the long term.

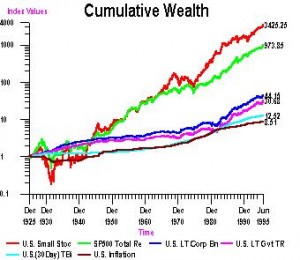

For a better understanding of the value of a long-term perspective, take a look at the following chart[iii]:

This chart shows the relative value of several asset classes from 1925 to 1995. The dark red line at the bottom is US inflation, while the bright green line is the S&P 500. Over time, the increased risk of investing in the S&P 500 has produced dramatically higher rewards relative to more stable investments, such as US Long Term Treasury Bills (the pink line).

3. Buy on sale!

Instead of being afraid to add to your 401(k) or IRA when the market is down or irregular, you should continue with your usual investment plan. Staying disciplined on this front will help you to take advantage of declines in the market rather than giving into them.

How does this work? Think about it this way: When equity markets are down, you have a chance to “buy low” and thus rebalance your portfolio according to your long-term strategy. While we all like to talk about buying low and selling high, it can be extremely difficult to do this in practice, especially when things are really good in one asset class or really bad in another, and most especially when things are uncertain.

Thus, you should make sure to have a plan in place for your allocation and stick to it, even if it means buying equities into a falling market or buying bonds when equities are skyrocketing. This discipline will help you to reap the benefits of a market rebound and stay on course during downturns.

4. Go global and get alternative

In your quest to have a well-diversified portfolio, you should not only allocate between equities and fixed income, but also diversify within these asset classes. For example, you probably diversify between small cap stocks and large cap, or sovereign debt and corporate debt. Additionally, however, be sure to look around the world for your diversification. While many economies are tied together to such an extent that their markets tend to move together, I believe there is still a lot of opportunity for diversification across the globe.

Furthermore, you might want to look to alternative investments for additional diversification. These assets tend to have low correlation to the broad market, which means that they generally hold their value even if the market is falling. Common alternative investments include futures contracts, commodities, floating rate fixed income investments, and hedged equity investments. Like global investments, many alternative investments can be accessed through mutual funds and ETF’s, which provide a high level of liquidity. For more information, take a look at my article about reducing risk through the use of alternative investments.

To summarize, when you’re worried about volatility, remember to keep in mind that it’s a common part of the market cycle. Keep your eye on the big picture of your portfolio in the long run, where volatility is part of the equation that makes equities such a powerful investment. Stay disciplined and stick to your investment plan, even when your emotions are begging you to do otherwise, and keep your portfolio well diversified to represent the global market and alternative investments. Finally, if you find that your concerns continue to grow despite this advice, be sure to talk to your financial advisor. A great advisor will not only help explain what’s going on in the market but will help you find a strategy that both positions you for the long run and keeps you feeling informed and knowledgeable in the short run.

[i]Yahoo finance -August 8th & 9th, 2011- SPX volatility index.”

[ii] Easterling, Ed. “Volatility in Perspective. Crestmont Research. December 31, 2010.

[iii] Campbell Harvey. “Historical Behavior of Asset Returns.”

Written by Bradford Pine

Bradford Pine Wealth Group – New York City Financial Advisors

The views and opinions expressed in an article or column are the author’s own and not necessarily those of Cantella & Co., Inc. It was prepared for informational purposes only. It is not an official confirmation of terms. It is based on information generally available to the public from sources believed to be reliable but there is no guarantee that the facts cited in the foregoing material are accurate or complete.

Comments may not be representative of the experience of other investors. Investor comments and experiences are not indicative of future performance or results. Views and opinions expressed in the comments section are the author’s own and not those of Cantella & Co., Inc. No one posting a comment has been compensated for their opinions.

Comments are closed.