School has started again, which for my family means a fresh start on the college planning roller-coaster. My son, Clay, is now a high school junior, and we are trying to help him stay focused on the big high school end-game — college — while juggling his many activities.

I’m sure for some readers I’m preaching to the choir: we all know how important college is, and trying to help our kids see it and find the right balance between school and chilling out can feel like a full-time job.

As a parent, you can’t help but worry: even though we’ve been through this already with my daughter Abby, I’m still amazed at how competitive the application process is. We’re doing a lot of strategizing and planning for Clay, and since I take time each month to write about finance, it would only be appropriate to not only speak about college advice, but to put a twist on it and show the comparison to retirement.

This month, I want to show you the parallels between college planning and retirement planning, and why it’s so important to practice what we preach to our kids by focusing time on our own futures.

Both of these areas require a concerted effort over a period of time, an understanding of your psychology and personal strengths, and the ability to keep working even though the payoff will only occur later. The message I keep hearing from admissions counselors is always the same: our children need to push themselves academically by taking the hardest classes their school offers, perform well on standardized exams, and find other ways to stand out from the crowd. Admissions counselors see a countless number of talented students, and they want to know what makes your child unique and different.

It’s a lot to take in — and a lot to do. But the good news is that there are roadmaps available, and the ways we can help prepare our children for admissions are strikingly similar to the ways we can help ourselves achieve a better retirement. Here are three important steps you can take.

1. Imagine yourself in the situation

For college Planning

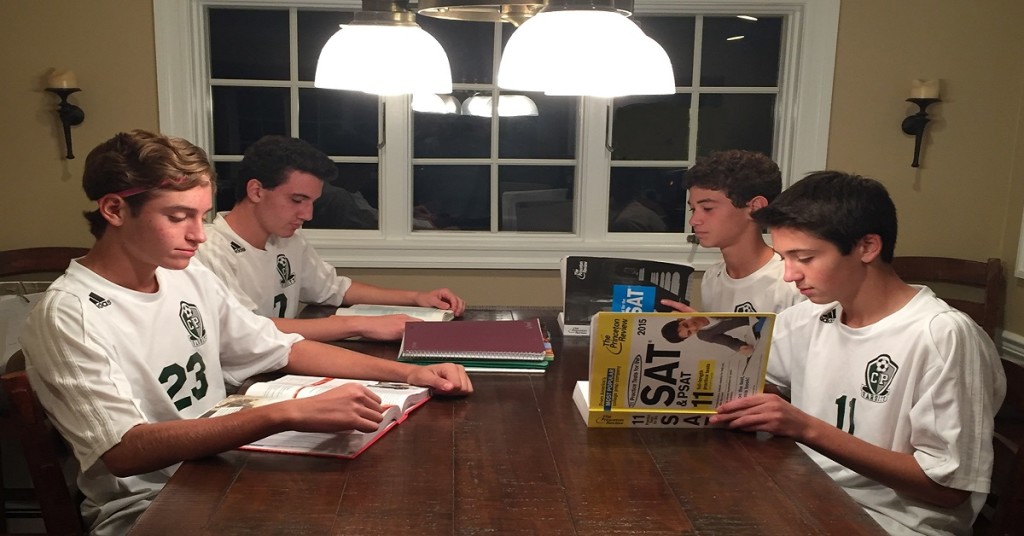

Staying focused on college or retirement isn’t easy. My son, as I mentioned, has a lot going on — and that’s before his normal teenage interest in having a social life. Finding time to study for the SAT when there’s also AP classes, two varsity sports, and driver’s ed can be difficult. The key is to find a balance without sacrificing the big picture.

That’s why I’m such a big fan of doing college visits as early as possible. It puts our children in the position of really seeing themselves as a college students and learning about the reality of what it takes to get there. The more competitive schools emphasize over and over that they don’t want to just see participation, they want to see impact. They want to know what each and every applicant did to be remembered by their high schools. These schools are also eager to accept students in the top 10 percent of the class — which is obviously a difficult feat for 90 percent of students. However, there are also a lot of schools who want to look at kids in the top 25 percent of their class. Finding the right list of schools is going to be a balance between performance and ambition.

We visited nine schools over the summer, and I definitely think it’s helping to motivate Clay to go the extra mile this year. In the end, nothing we say as parents could ever match the real-life message of an admissions counselor at an amazing school telling it like it is.

For retirement planning

In the same way, taking the time to really visualize our retirement can help motivate us to plan better and take action sooner. If college visits make the idea of being in college “real” to our kids, imaginary “visits” to our ideal retirement can do the same for us. Do you want to travel a lot? Move to the city? Or maybe buy a second home? Really seeing your retirement future can help you take stock of what resources you will need to have in place financially in order to make your dreams a reality.

2. Develop a strategy

For college planning

The second part of preparation is taking a good look at what you need to do and making a plan that puts you on the path to potential success.

For example, the SAT exam is changing this year, and there’s a lot of concern among parents about how to handle it. Do you study for the old test? The new test? Prepare for both?

Given the uncertainty, we decided that Clay would focus on taking the old test. My reasoning is that SAT prep companies already have know-how and experience in teaching it, and if he takes it early Clay will always have the option to take the new test later. While no one really knows how colleges will handle scoring, I suspect they might allow super-scoring between the old and new tests — meaning that schools will use the best score across test for each subject area when putting together a student’s profile. Either way, giving Clay every opportunity to excel at the old test while leaving the option open to take the new one will, I believe, set him up for a better potential result.

For retirement planning

Just like we strategize with our kids in situations like these, we need to think about the best path to take when it comes to retirement planning.

This doesn’t just include setting money aside, although that is a very important start. It means thinking through questions of asset allocation, managing your portfolio, and preparing for the inevitable bumps in the road. Can your portfolio withstand volatility? Are you diversified enough? Most importantly, are you saving enough?

3. Stay focused for the long haul

For college planning

Helping your child stay focused on college isn’t always easy. It’s sometimes difficult to get the point across about what needs to be done and the importance of consistency and follow-through.

For me, one of the many things you can do is to just ask a simple question: How would you feel if you received a rejection letter from your top school — knowing that if you just applied yourself a little more you would have been accepted? I try to help my son understand that the only way to avoid regret is to do whatever he can to plan for success. Sometimes things don’t work out the way we want, but the least we can do is to put ourselves on the right path and give it our best.

This is an important lesson for our children. All those day-to-day decisions add up over time, and in the end they have consequences. Of course, this is not directed at the self-motivated, very hardworking child, and this is not a fool-proof plan designed to give you 100 percent certainty of getting into the school you want. Unfortunately, the latter just doesn’t exist. All you can do, again, is put yourself on the right path and take advantage of the resources, time, and energy you have.

For retirement planning

Finally, like college admissions, planning for retirement requires effort and the ability to stay on track. We work to make sure our children stay on course throughout high school, but we need to take the same advice and keep focused ourselves. Whether that means checking in on your plan with an advisor or regularly on your own, it’s important to take stock of where you are at least once a year. Does your portfolio need to be rebalanced? Can you contribute more to your 401(k) or IRA? Are you satisfied with your investment strategy?

The philosophy of “Do as I say, not as I do” isn’t healthy — for us or our children. We need to make sure to put ourselves on the right path financially and stay focused on doing what we can for the future. When in doubt, ask yourself how you’ll feel when you reach 65: did you do everything you could, or could you have applied yourself better? These aren’t easy conversations to have with yourself, but they’re just as important as the ones you have with your child about college planning.

In this way, you’ll not only be helping yourself for the long run, but you’ll be setting a powerful example to your child about what discipline and focus really looks like.

Getting started

If you’re ready to take that first step towards “strengthening your application” for your dream retirement, take a look at my eBook, 10 Tips You Need to Know About Your IRA Rollover. This book gives easily-understandable and actionable advice for taking the reins of your languishing IRA or 401(k) account.

Are you looking for more tips on handling the college process? Take a look at my quick primer on college planning. I’ve also written about how to get more scholarships and better financial aid, how to reduce the financial burden of college, and some of the financial and life lessons I took from moving my daughter, Abby, into her first dorm room.

Sending your kids to college is a wild ride emotionally and, for most of us, financially as well. So taking action today to prepare for your future is not only good for you, it’s a great example to set for your children before they set out on their own. The best part is that it’s never too late to start: with knowledge and the self-empowerment to take a first step, you can always help to improve your life over the long run.

.

Written by Bradford Pine with Anna B. Wroblewska

.

To learn about retirement savings, download my free eBook, “10 Tips You Need to Know About Your IRA Rollover.” This short book is packed with critical information that will help you make the right decisions about your retirement savings.

Written by Bradford Pine

Bradford Pine Wealth Group – New York City Financial Advisors

The views and opinions expressed in an article or column are the author’s own and not necessarily those of Cantella & Co., Inc. It was prepared for informational purposes only. It is not an official confirmation of terms. It is based on information generally available to the public from sources believed to be reliable but there is no guarantee that the facts cited in the foregoing material are accurate or complete.

Comments may not be representative of the experience of other investors. Investor comments and experiences are not indicative of future performance or results. Views and opinions expressed in the comments section are the author’s own and not those of Cantella & Co., Inc. No one posting a comment has been compensated for their opinions.

Comments are closed.